Learn how to buy Nvidia stock from India with step-by-step guidance. Discover the process, requirements, and tips for investing in Nvidia shares from India.

Setting Up the Trading Account

Here are the basic steps to purchase Nvidia stock from India with some additional context and clarification: First, you will need a trading account with a brokerage that supports international trading. Some well-known options for Indians looking to invest overseas include Zerodha, Upstox, and HDFC Securities. Be sure to research each brokerage’s fees, supported markets, and account minimums to choose the best fit for your needs.

Option for Indian Investors

There are a couple options for Indian investors interested in gaining exposure to the US stock market. One approach is to open an international trading account, which allows buying shares of individual US-based companies. This provides direct ownership of stocks and more control over the specific companies held. However, it also requires actively researching and selecting companies. A more convenient alternative is investing in US stocks through exchange-traded funds (ETFs) or mutual funds. ETFs and mutual funds offer diversified.

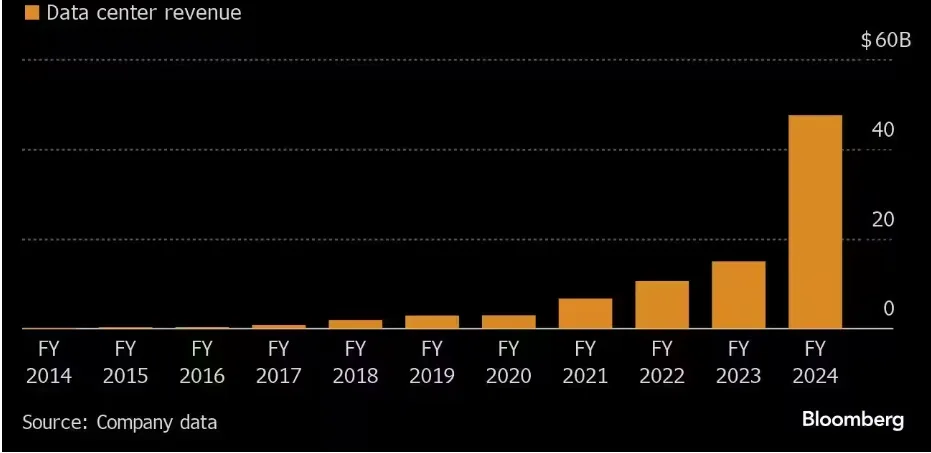

Brief History of Nvidia’s Market Performance

Nvidia has captured significant attention from stock market investors globally. The US technology corporation surpassed a $2-trillion valuation on February 23rd, with their share price increasing almost 22 percent over just two days. Their stock has more than doubled in the past year alone. As a leader in graphics processing units and artificial intelligence, Nvidia has experienced immense growth. Their revolutionary chips power many applications from video games to self-driving cars. This rapid rise highlights Nvidia’s successful strategy and promising future prospects within industries undergoing digital transformation. While some volatility is normal, most analysts expect the company to continue innovating and delivering long-term returns for shareholders.

Investing in Nvidia and Other American Corporations

The company’s swift and dramatic ascent to success has caught the attention of investors around the globe, many of whom are likely now curious about how they too can gain exposure and share in the organization’s prosperity. After such a rapid rise to prominence, people everywhere have undoubtedly taken notice of this enterprise’s remarkable trajectory and are wondering what sort of opportunities may exist to participate in and benefit from its continued growth and market dominance.

Nvidia has greatly helped from the AI competition as man-made brainpower models are made utilizing the organization’s graphic processors. On February 21, Nvidia detailed income of $22.1 billion which was 265 percent up from the earlier year. Net pay increments by 769 percent YoY to $12.3 billion, which surpassed the desires of Wall Street.

Indian investors who wish to participate in the uptrend and put their money in Nvidia or other popular American corporations like Microsoft and Apple have some options available. They can establish an international brokerage account that permits direct purchase of shares in overseas firms. Alternatively, investing in U.S. stock through Exchange Traded Funds or Mutual Funds that track American market indices provides exposure without the hassle of trading foreign stocks individually.

Also read: Top 10 Investment Tips for New Investors

Opportunities Through ETFs and Mutual Funds

ETFs allow tapping into sectors or styles by acquiring a single security, while mutual funds pool capital from many investors under professional management. Both provide cost-effective diversification across many companies with a single trade. Clarifying the different pathways for Indians hoping to share in the prosperity of well-known tech giants on the other side of the globe while mitigating risk through diversification can help them determine the most suitable approach.

Leveraging Indian Brokerages for International Investing

Indian investors have multiple options to open an international trading account through prominent Indian brokerages that enable investing overseas. Brokerages like ICICI Direct, HDFC Securities, IIFL Securities, Kotak Securities and Axis Securities have collaborations with global trading platforms, allowing their clients convenient access to invest abroad services.

Through partnerships with international exchanges, investors can leverage these established Indian brokerages as a gateway to explore opportunities in foreign markets. With an international trading account, individuals get the ability to buy stocks and other securities outside of India, diversifying their portfolio beyond domestic boundaries. The collaborations between Indian financial firms and global investment platforms provide local investors an easy way to venture into overseas investing through a familiar intermediary.

While newer fintech apps like Angel One, Vested, and IND Money allow you to conveniently establish an international trading account from your phone, it’s important to thoroughly research any platform before transferring funds or placing trades. These digital brokers aim to simplify global investing, but you’ll want to carefully review account fees, investment options, customer service availability, and security measures to ensure your needs.

Considerations for Trading Overseas

While investors have the option to use large international brokerages like Interactive Brokers, Charles Schwab, and Ameritrade to set up foreign trading accounts, directly trading overseas comes with some important things to consider. These brokerages provide access to markets all around the world, allowing investors to expand their portfolios internationally. However, different countries have their own rules and regulations regarding financial markets. Investors must research these regulations to ensure.

Investors should be aware that there is a yearly limit on how much money can be transferred tax-free from a Canadian account to a trading account in the United States. Specifically, the Lifetime Remittance Exemption (LRS) caps such tax-free transfers at $250,000 per calendar year. This important threshold aims to balance allowing Canadians investment flexibility while still collecting owed capital gains taxes.

Alternative Options for Nvidia Exposure

There are a couple alternative options for investors who wish to gain exposure to Nvidia’s stock without opening another individual trading account. They can consider investing in mutual funds or exchange-traded funds (ETFs) that allocate a portion of their portfolio to owning shares of Nvidia. Many popular index funds and tech sector ETFs have positions in Nvidia since it is a leading company in the graphics processing and artificial intelligence industries. By investing through a mutual fund or ETF, individuals

ETFs like Motilal Oswal Nasdaq 100 and Mirae Asset NYSE FANG+ offer investors opportunities to hold portfolios containing some of the largest and most innovative companies in sectors like technology in a simple, low-cost manner. These funds allow individuals to gain exposure to top American businesses such as Nvidia through a singular, passively-managed investment instead of having to purchase multiple stocks independently. With diversified baskets of stocks in their indexes, these ETFs can serve as convenient avenues for gaining representation of leading US corporations.

Mutual Funds Offering Nvidia Exposure

Some of India’s leading mutual fund houses like Axis, ICICI, Mirae and Motilal held significant stakes in Nvidia Corporation, with their combined holdings totalling around 1.7 lakh shares. Based on Nvidia’s current stock price, the total value of these shared holdings is estimated to be around $132 million. While these funds have exposure to Nvidia through investments in international equities, the sharp decline in its share price following weak guidance would have negatively impacted the net asset values of.

Also read: What is NAV in Mutual Funds: A Comprehensive Guide

There are a few mutual funds in India that provide exposure to the US-based technology company Nvidia through their investment in its stock. Franklin India Feeder – Franklin U.S. Opportunities Fund and Edelweiss US Technology Equity FOF both allocate a portion of their portfolio to buying shares of Nvidia and other leading tech corporations. Additionally, PGIM India Global Equity Opportunities Fund offers Indian investors exposure to high-growth international businesses like Nvidia through its globally diversified stock selection. Navi US Total Stock Market FoF also includes Nvidia within its broad market index tracking strategy, providing cost-effective access to America’s large.